The jurisdiction, now home to 85 digital license holders, will offer an all-inclusive solution of a shariah-based digital regime leveraging on its leadership in Islamic finance, introducing socially based financial instruments

KUALA LUMPUR, Malaysia, Oct. 22, 2021 /PRNewswire/ — Labuan International Business and Financial Centre (Labuan IBFC) is rapidly revolutionising its digital offerings, entrenching its commitment to become a facilitator of Asia’s digital revolution, a key driver of the centre’s success in recent years.

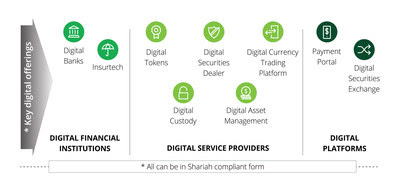

Labuan Financial Services Authority (Labuan FSA) – the jurisdiction’s regulator – provides an innovative licensing regime to support this evolving digital financial landscape. Allowing digital financial services (DFS) firms to operate within a live market environment, anchored on innovation, intermediation and financial inclusion.

“The DFS in Labuan IBFC is continually growing in recognition of the progressive approach that the centre has taken in embracing the digital revolution, by being as facilitative as possible to enable innovative digital business to take root in Labuan IBFC,” said Labuan FSA Director General, Nik Mohamed Din Nik Musa during his Welcome Address at the third Connecting Digital Ecosystems Asia (CoDE Asia 2021) today.

He added: “Labuan IBFC is envisioned to become a digital-based gateway with Islamic finance capabilities for all global investors and players as the future of Islamic finance looks ever promising. The digital transformation in Islamic finance positively contributes to the evolution and innovation of Islamic financial products and services in a rapid tone.”

“As we continue to strengthen Islamic finance footing in the region, our focus now is to realise the full potential of digital opportunities by offering an all-inclusive solution of a shariah based digital regime leveraging on Islamic finance and social-based finance instruments. This could further expand Islamic finance development across emerging markets while building connectivity with wider Islamic finance industry.”

“As digitisation for the financial sector evolves, regulatory bodies globally will be posed with the balancing act of determining appropriate ways of regulating these changes vis-a-vis promoting market breakthrough and innovations. Ensuring stability will remain of paramount importance as financial transactions become more seamless, intangible and borderless. Therefore, Labuan FSA is committed to adopting a facilitative approach by developing ‘fit-for-purpose’ requirements to cater for emerging business technologies,” said Nik Mohamed Din.

This year, Labuan FSA launched two key policy documents – the Guiding Principles on Business Continuity Management to enhance the Labuan financial institutions’ operational resilience; as well as a digital governance and cyber resilience framework which aims to protect DFS providers from cyber threats.

Farah Jaafar, CEO of Labuan IBFC Inc, said, “Being home to one of the fastest growing digital families in Asia, our ethos of constant engagement with industry coupled with innovation and facilitation, puts us in good stead to embrace the next digital evolution, governed by sound regulatory parameters. This curates a regulated digital ecosystem, providing synergy between wholesale financial intermediation and digitalisation allowing our licensees to operate in a facilitative borderless environment.”

As at September 2021, the number of DFS providers that have been approved to operate in the Labuan IBFC digital space has grown to 85 licensees, having licensed 25 intermediaries as of September 2021. The key licensees include 2 digital banks, 1 insurtech and 1 digital securities exchange, 16 payment systems providers, 18 credit token issuers and 33 money brokers (digital currency exchanges). Out of the total number of DFS providers in Labuan IBFC, the majority were licensed to provide digital currency trading platform, issuance of digital token and e-payment system or e-wallet.

Labuan IBFC’s debut as a digital friendly jurisdiction began in 2017 with just one licence and has since expanded with a wide range of digital businesses and players, from digital banking and insurtech to intermediaries such as robo-advisory, digital asset exchanges, crypto trading platforms, tokenisation licences and e-payment systems.

Having celebrated its 30th year of establishment in 2020, Labuan IBFC is now home to more than 5,000 active entities which include 70 banks, 232 insurance and insurance-related entities, 65 trust companies and other business sectors, with an ecosystem creating a robust environment promoting the growth of digital business.

The 3rd edition (virtual) of Connecting Digital Ecosystems Asia 2021 (CoDE Asia 2021) themed “Future Forward: Next Gen Digital Ecosystems” was attended by more than 400 regional delegates and featured a line-up of industry players and subject matter experts, discussing the current and emerging developments in the digital financial industry.

In conjunction with the conference, a joint white paper entitled ‘Curating a Regulated Digital Ecosystem’ was launched. The paper produced with Deloitte, examines the challenges faced by regulators in an ever-evolving digital landscape, and how jurisdictions can support and facilitate a well-balanced regulatory and business conducive environment.

For more information and copy of the white paper, please visit: www.labuanibfc.com.

ABOUT LABUAN IBFC

ASIA PACIFIC’S MIDSHORE INTERNATIONAL BUSINESS AND FINANCIAL CENTRE

Labuan International Business and Financial Centre (Labuan IBFC), Malaysia, through our internationally recognised yet business-friendly legal framework, is the preferred international business and financial centre in Asia. Established in 1990, Labuan IBFC is regulated by the Labuan

Financial Services Authority (Labuan FSA), statutory Regulator under the purview of the Ministry of Finance, Malaysia.

As a midshore jurisdiction, we offer global investors and businesses the benefits of being in a well-regulated and supervised jurisdiction, which adheres to international standards of compliance in tax transparency. We also provide fiscal neutrality and certainty in a currency neutral operating environment. Labuan IBFC, located in the centre of Asia, boasts a cost-efficient enabling environment making it an ideal location for substance creation for both global businesses looking at penetrating Asia or Asian entities aiming to go global.

Offering a wide range of business structures and investment solutions catered to cross-border transactions and international business dealings including fintech related solutions. We also provide services and solutions in niches such as risk management, commodity trading, reinsurance, wealth management, international business companies and Islamic financial services. Operating with clear and comprehensive legal provisions, guidelines and practice notes, enforced by a single regulator, Labuan FSA, Labuan IBFC provides an ideal jurisdiction for both corporates and high-net-worth individuals with international exposure.

To keep up with everything about Labuan IBFC, follow us on LinkedIn, Facebook or Twitter. Alternatively, visit www.labuanibfc.com.

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/

Logo – https://mma.prnewswire.com/